Introduction

In the digital age, where smartphones have come an integral part of our lives, mobile payment systems have surfaced as an accessible and secure way to conduct deals. These systems allow druggies to make payments, transfer plutocrats, and manage their finances directly from their mobile bias. With the wide relinquishment of smartphones and the advancements in technology, mobile payment systems have endured exponential growth, transubstantiating the way we interact with plutocrats.

Integration and Versatility

One of the crucial advantages of payment systems is the unequaled convenience they offer. Gone are the days when you had to carry a portmanteau filled with cash or multitudinous credit cards. With a mobile payment system, a simple valve or checkup of your smartphone is each it takes to complete a sale. Whether you are paying for groceries, unyoking a bill with musketeers, or copping goods online, mobile payment systems give a flawless and hassle-free experience.

also, mobile payment systems offer availability to a vast population that preliminarily faced challenges in penetrating traditional banking services. In developing countries, where the number of people with bank accounts is limited, mobile payment systems have opened up openings for fiscal addition. Indeed individuals without a bank account can now shoot and admit plutocrats, pay bills, and make purchases using their smartphones, empowering them economically.

Security and Fraud Protection

enterprises over security have always been a major factor in the relinquishment of digital payment styles. still, mobile payment systems have enforced robust security measures to cover stoner information and deals. By using encryption technologies, tokenization, and biometric authentication, similar to fingerprints or facial recognition, these systems ensure secure deals and safeguard stoner data.

also, payment systems offer enhanced fraud protection compared to traditional payment styles. Each sale generates a unique law or commemorative, precluding the exposure of sensitive payment details to implicit hackers or unauthorized parties. In the event of a lost or stolen phone, druggies can ever disable mobile payment capabilities, furnishing a redundant subcaste of security and peace of mind.

Integration and Versatility

payment systems have seamlessly integrated with colorful diligence, making them protean and adaptable to different scripts. Whether you are at a retail store, eatery, or indeed a road seller, the capability to accept mobile payments has come decreasingly common. This integration has led to bettered client gests, shorter ranges, and increased effectiveness for businesses.

likewise, payment systems have expanded beyond traditional point-of-trade deals. Peer-to-peer ( P2P) payment services enable individuals to transfer plutocrats to musketeers and families incontinently. unyoking bills, paying rent, and refunding debts have come royal tasks. also, mobile holdalls allow druggies to store fidelity cards, gift cards, and indeed digital boarding passes, reducing the need for physical documents and clutter.

Driving Innovation and Economic Growth

The wide relinquishment of payment systems has prodded invention in the financial technology sector. Fintech startups and established companies are constantly developing new features, enhancing stoner gests, and exploring the eventuality of arising technologies, similar to the blockchain and digital currencies, within the mobile payment ecosystem. These advancements haven’t only converted the way we distribute but have also contributed to profitable growth and job creation.

likewise, mobile payment systems have played a significant part in driving the growth of commerce. With the convenience of mobile payments, online shopping has come more accessible and flawless. The capability to make quick and secure payments has increased consumer trust and boosted global-commerce assiduity.

Contactless Payments and Near Field Communication( NFC)

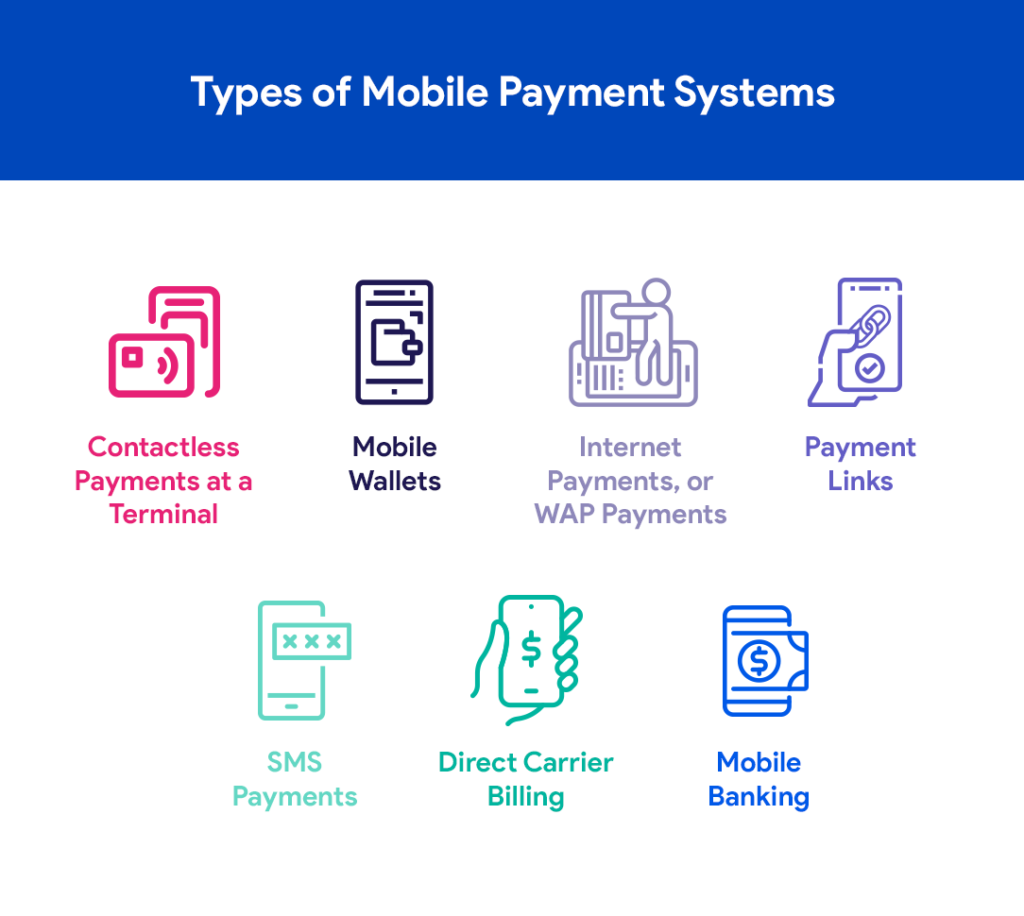

payment systems frequently use contactless payment technology, allowing druggies to make deals by simply tapping their smartphones on a compatible payment outstation. Near Field Communication( NFC) technology enables this flawless communication between the smartphone and the payment terminal, barring the need for physical contact or snatching of cards. This technology has come decreasingly current, with numerous smartphones now equipped with NFC capabilities.

Mobile holdalls and Digital Payment Apps

payment systems are generally eased through mobile holdalls or digital payment apps. These apps act as a secure depository for payment information, linking the stoner’s bank accounts, credit or disbenefit cards, and other fiscal instruments. druggies can store their payment details in the app and access them when making a sale, barring the need to carry physical cards. Popular mobile holdalls include Apple Pay, Google Pay, Samsung Pay, and PayPal.

QR Code Payments

In addition to NFC- grounded contactless payments, mobile payment systems frequently support QR law payments. merchandisers induce a unique QR law representing the sale details, which druggies can overlook using their mobile payment app to complete the payment. This system is extensively used, particularly in countries where QR law relinquishment is high, furnishing a protean and accessible payment option.

Global Expansion and Relinquishment

payment systems have gained significant traction encyclopedically, with wide relinquishment in numerous regions. In countries like China, mobile payment systems have come deeply integrated into everyday life, with a vast maturity of deals conducted through mobile apps like Alipay and WeChat Pay. also, in countries like India and Kenya, mobile payment systems have played a pivotal part in fiscal addition, furnishing individualities with limited access to traditional banking services the capability to distribute digitally.

hookups and Collaboration

payment systems have forged hookups with colorful stakeholders to enhance their capabilities and expand their reach. Collaborations with banks, fiscal institutions, and merchandisers enable flawless integration of mobile payments into being structured. hookups with technology companies, similar to devise manufacturers and operating system providers, have further eased the growth and relinquishment of mobile payment systems.

Challenges and Future Outlook

While payment systems offer multitudinous benefits, there are challenges that need to be addressed. These include enterprises over data sequestration and security, interoperability between different mobile payment platforms, and icing availability for individualities without smartphones or dependable internet connectivity.

Looking ahead, mobile payment systems are anticipated to continue evolving. The integration of arising technologies, similar to blockchain and digital currencies, could potentially enhance the security and effectiveness of mobile payments. also, the growth of the Internet of Effects ( IoT) bias and wearables may further expand the compass of mobile payments, allowing druggies to make deals through a wider range of connected biases.